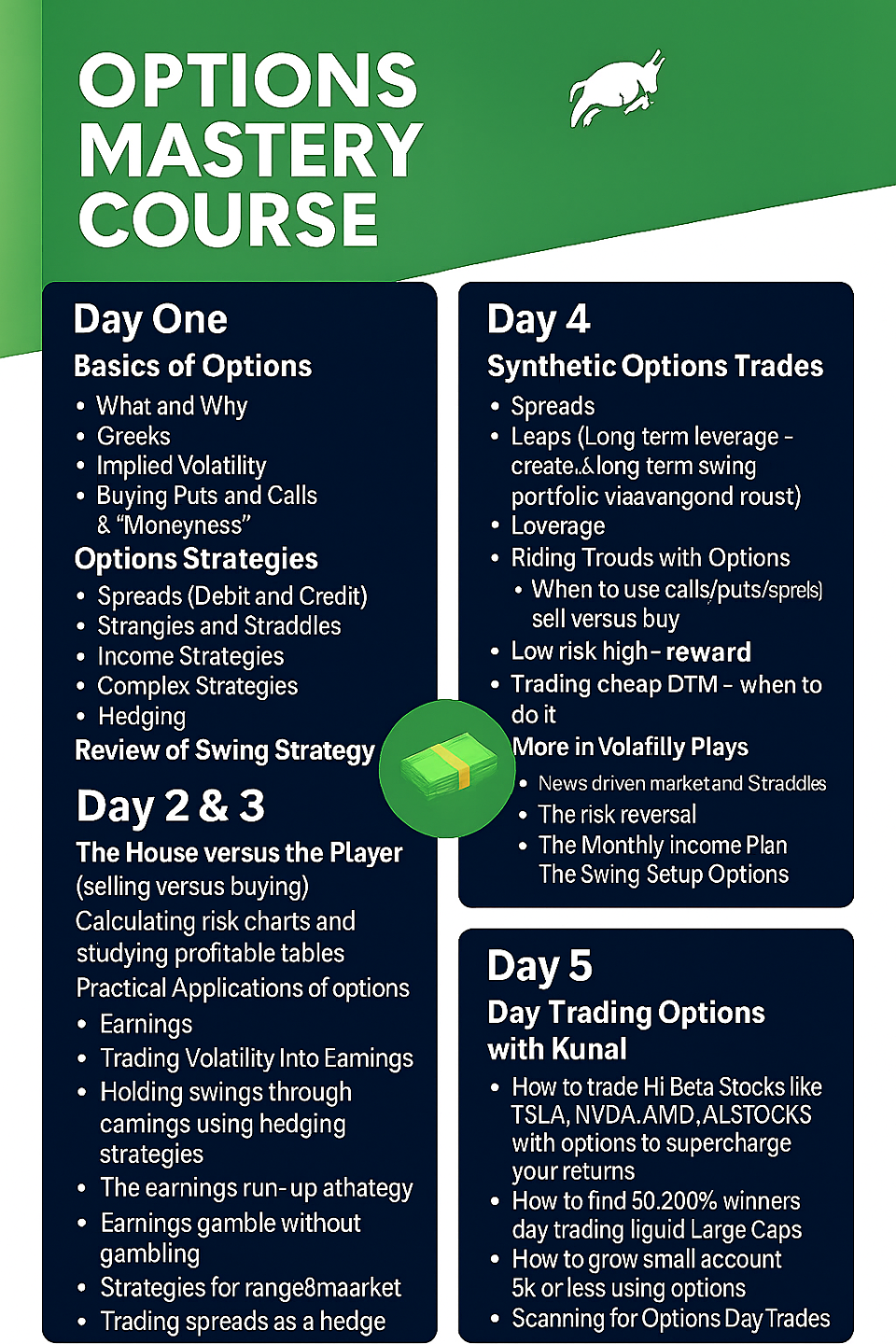

The Options Playbook: Swing Trading & Day trading With Paul & Kunal

- Day One (This is basically the entire first options class and swing)

- Basics of Options

- What and Why

- Greeks

- Implied Volatility

- Buying Puts and Calls & “Moneyness”

- Options Strategies

- Spreads (Debit and Credit)

- Strangles and Straddles

- Income Strategies

- Complex Strategies

- Hedging

- Review of Swing Strategy

- Day 2 & 3 (The new practical applications)

- The House versus the Player (selling versus buying)

- Calculating risk charts and studying profitable tables

- Practical Applications of options

- Earnings

- Trading Volatility into Earnings

- Holding swings through earnings using hedging strategies

- The earnings run-up strategy

- Earnings gamble without gambling

- Strategies for bull and extended markets

- Strategies for rangebound market

- Strategies for bear markets

- Market neutral strip strategy (optimal spot to trade volatility)

- Trading spreads as a hedge

- Small Accounts Specifics

- Synthetic Options Trades

- SpreadsLeaps (Long term leverage - create a long term swing portfolio with a small account)

- Leverage

- Riding Trends with Options

- When to use calls/puts/spreads/sell versus buy

- Low risk high reward

- Trading cheap OTM - when to do it

- More in Volatility Plays

- News driven market and Straddles

- The risk reversal

- The Monthly Income Plan

- The Swing Setup Options Checklist and Cheat Sheet

- Day 4 Bonus Session

- Tons of examples

- Q & A

Day 5 Day Trading Options with Kunal

- How to trade Hi-Beta Stocks like TSLA, NVDA, AMD, AI STOCKS with options to supercharge your returns. How to find 50-200% winners day trading liquid Large Cap stocks

- How to grow small account 5k or less using options

- How to choose when to trade stocks vs options

- Scanning for Options Day Trades . Scalp vs Short Swings